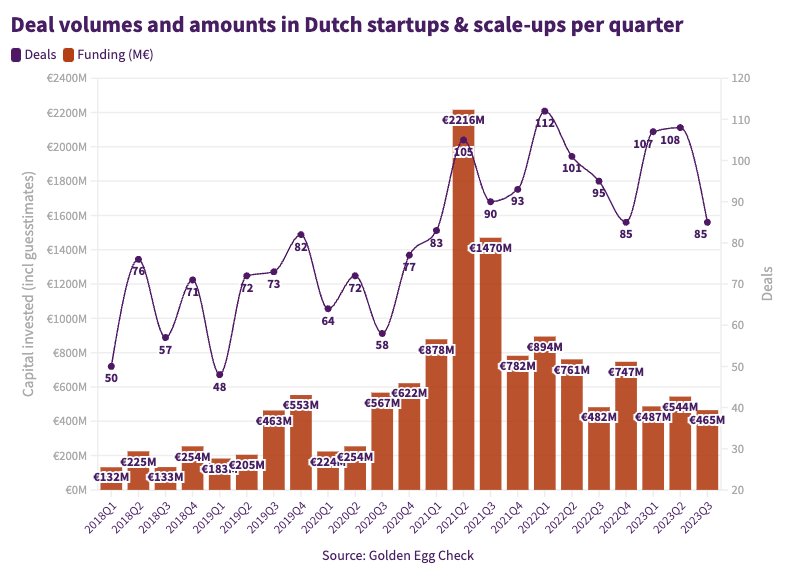

Dutch startups raised at least €420 million in venture capital in the third quarter of 2023. Although this represents a slight decrease from the second quarter (€525 million) and the third quarter in 2022 (€435 million), it follows a usual seasonal pattern. The composition of deals by phase is similar to last year. This is according to the Quarterly Startup Report, a quarterly data analysis by Dealroom.co, Golden Egg Check, KPMG, the Regional Development Companies (ROMs), Dutch PE&VC Association (NVP), Dutch Startup Association (DSA) and Techleap.

Bright spots and challenges

The number of deals identified by analysts of the Quarterly Startup Report also decreased. Last quarter, 85 deals came to fruition, down from 98 in the third quarter of last year and over 100 in previous quarters. Although fewer investments are typically made and announced during the summer season, the sharp decline is a concern.

Against the trend of recent quarters, there were slightly more large deals to record in the past quarter. Some 15% of investments were larger than €15 million, compared to 8-10% in the first quarters of the year. This seems to be a tentative sign of recovery that venture capitalists are again investing more frequently in later-stage companies with larger amounts. At the same time, the share of smaller deals (€1-4 million) fell to 34% from 40% in the first quarter.

Estimates from Golden Egg Check

Golden Egg Check expects the €420 million to be an underestimate. First, because the analysts are picking up signals from the market that companies are raising internal rounds, from existing shareholders, to extend their runway. These are typically not the rounds that startups like to publish. They therefore expect fewer investments to be disclosed than actually take place.

Second, investments are disclosed without disclosing an amount. Like every quarter, Golden Egg Check’s analysts estimate how large these investments are likely to be, based on investors’ usual investment amounts and the stage the company is in.

Based on the estimates of how large the investments were that were disclosed without size, Thomas Mensink of Golden Egg Check estimates that a total of about €465 million was invested in Dutch startups and scale-ups in Q3.

When analyzing investments in Dutch startups, there are always ‘edge cases’. Golden Egg Check has listed these cases for justification in the document with their considerations.

Biggest deals in Q3

Neobank bunq raised the largest investment last quarter totaling over 44 million euros. The rest of the top 11 biggest deals are a mix of software companies such as Lepaya and Framer, and relatively many high-tech companies (including SMART Photonics, Rocsys and VSParticle) and climate technology companies (including Meatable and HyET Solar).

This is the complete top 11:

- bunq €44.500.000

- SMART Photonics €40.000.000

- Lepaya $38.000.000

- MYCB1 Group $45.000.000

- Rocsys $36.000.000

- Meatable $35.000.000

- Framer $27.000.000

- Sensorfact €25.000.000

- Nearfield €16.000.000

- HyET Solar €14.500.000

- VSParticle €14.500.000