We provide insight on relevant startups

& scale-ups

Looking for the right startup?

We work with hundreds of startups each year, and through funding analysis and involvement in startup competitions we see thousands of them each year. Some are incredibly good, many are (at best) too early for an outside investor. We can scout which startups fit you or your fund. We can also help with screening: assessing, classifying and benchmarking startups, both as external analysts and by facilitating your screening process with our software tools. Finally, we make it as easy as possible to match startups and investors through StartupRoulette.

Startup database

We structure the scouting process for investors and make it more transparent and faster. We believe it is in the best interest of both entrepreneurs and investors if they can find each other more easily, preferably long before the startup needs funding.

We have the largest curated database in the Netherlands with good, relevant tech startups that are (or soon will be) looking for funding. We make this database available to investors as a SaaS model. Our analysts are available for additional analysis and clarification.

Do you have a specific question about a particular sector or type of startup? Or is a one-time insight enough? Then perhaps a specific scouting project is more appropriate. We will provide a report with relevant startups and their characteristics.

Startup screening

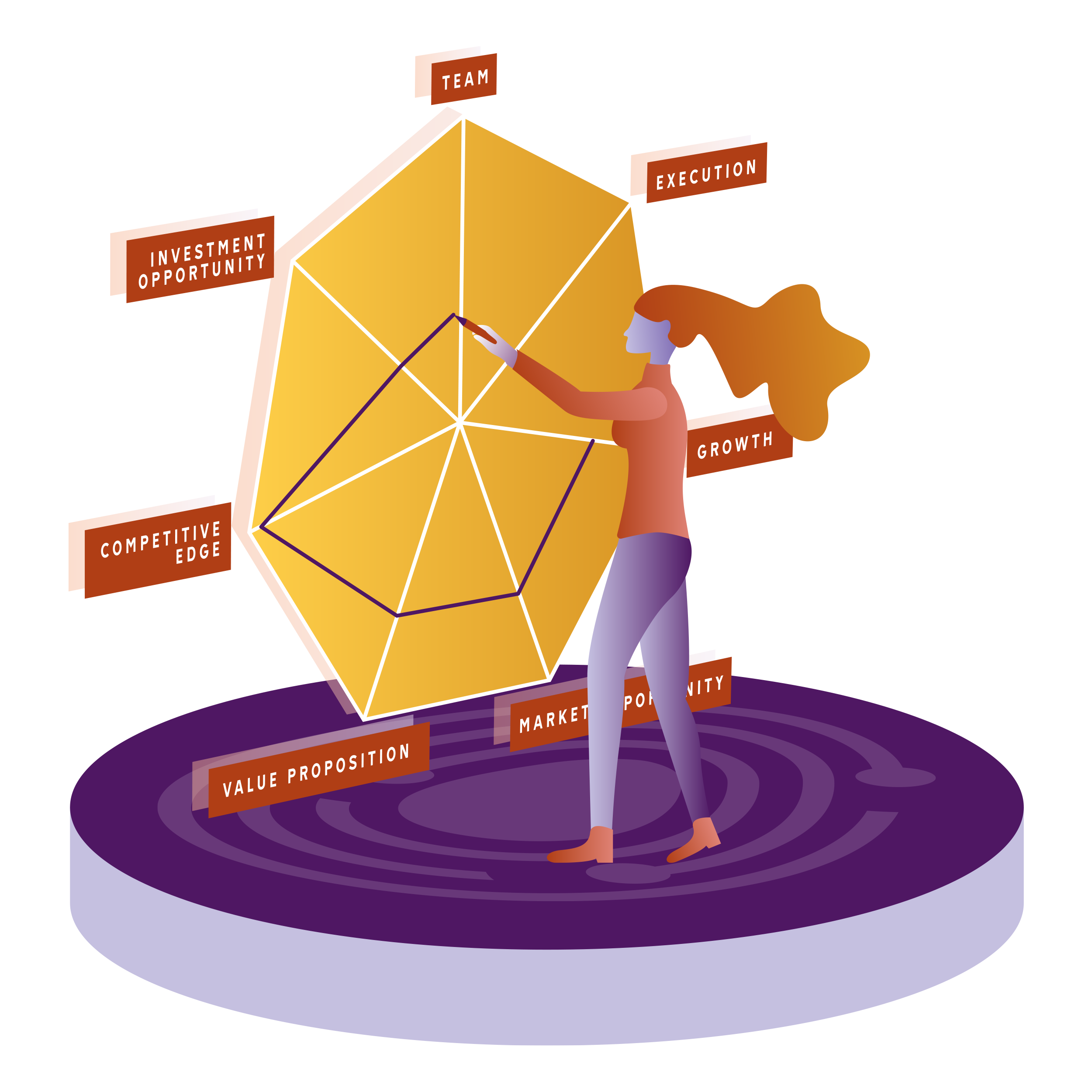

You probably have a certain set of criteria by which you evaluate startups, implicitly or explicitly. We have developed an assessment based on the 21 most important criteria of venture capital investors. These criteria include the team, value proposition, growth and competitive edge.

We can offer you the software tools to assess startups in a structured and objective way. We can also perform a (second opinion) assessment for you. In that case we assess the startup on potential and feasibility and give a substantiation of the pain points and growth signals. This helps you to invest more consciously, and to build up data to eventually learn about startup success and failure factors.

If we do multiple assessments (e.g. for seed-funds and accelerator programs) we will also benchmark the startups

Investors in our network

We collaborate with most venture capital funds in the Netherlands and increasingly with foreign VCs. Also our network with angel investors is large and diverse.