We findconnecthelpinvestanalyse

startups,

scale-ups, investors & corporates

We findconnecthelpassessanalyse

startups, scale-ups, investors & corporates

We are startup analysts.

We look at startups, investors and venture capital from an analytical point of view. By doing so, we help startups validate their plan and increase their investor readiness. And if it makes sense for both parties, we match startups with relevant investors and corporates, and vice versa.

Also we invest in startups as co-investor together with a lead VC or a group of angels investors.

Recent posts

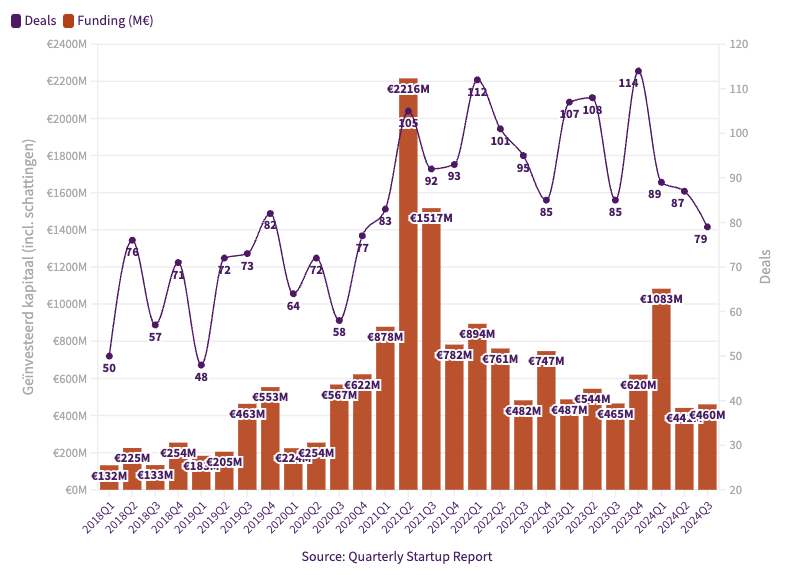

As startup analysts, we collect and analyze a lot of data about the startup ecosystem.

You can find our insights about the startup and venture capital market in our blog.