With all the warning that ‘winter is coming’ in the startup market, I was wondering if we could already see some signs of this in the Dutch tech ecosystem. Two weeks ago, our partners* and us published a short press release about the Q2 funding data. Now, let’s dive a bit deeper and provide some additional context.

Q2: Free fall or early recovery?

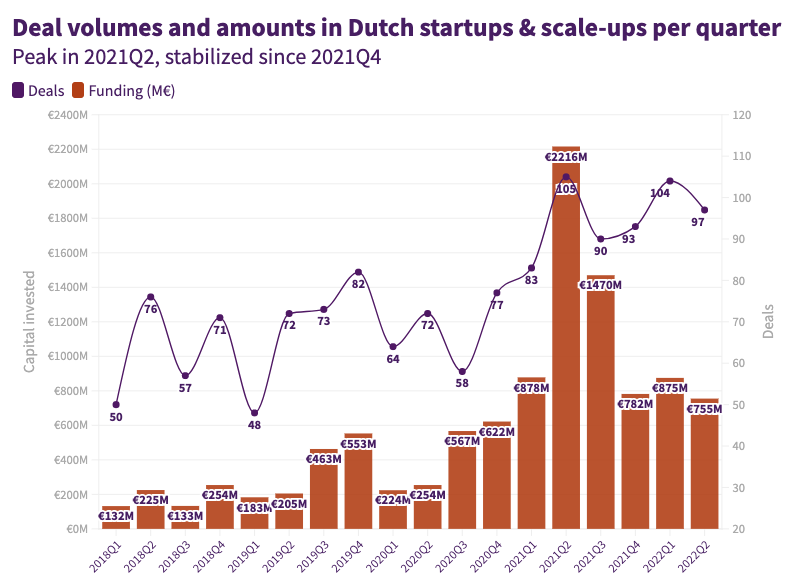

Since we started quantifying the Dutch venture capital market in 2017, each year was a new record year, with a high peak in 2021:

2021 was an insane year largely because of some mega rounds (Messagebird ($800M), Mollie ($800M) and Picnic (€600M) for example). I guess they timed their rounds well (hopefully they can deal with the pressure of the accompanying valuations though).

2022 so far is not bad at all with an estimated €1.6 billion invested (including our estimates of undisclosed deal amounts). The total invested amount is already close to the sum in 2020. Q1 and Q2 are typically slower seasons (except in 2021) so I would expect that at the end of the year 2022 will go down in history as the second highest year (in amount). In terms of number of investments, 2022 could even top 2021.

Now let’s have a closer look at the quarterly deal volumes and total investment amounts per quarter in the Netherland:

Things were ramping up nicely in the first half of 2021. After that, the total invested amount went down and stabilized around €750-800 million per quarter. Q1 2022 is in invested amount very similar to Q1 2021 (€875M vs. €878M), but Q2 is far off (€755M vs. €2.2B).

So far the number of investments has not come down that much (around 100 in the last two quarters). It could be the case that there is some reporting lag: the deals that were announced (and counted) in Q2 have maybe been signed in Q1 already. In that regard, we have to wait what will happen in Q3 since the alarming messages from Y Combinator and others came in Q2.

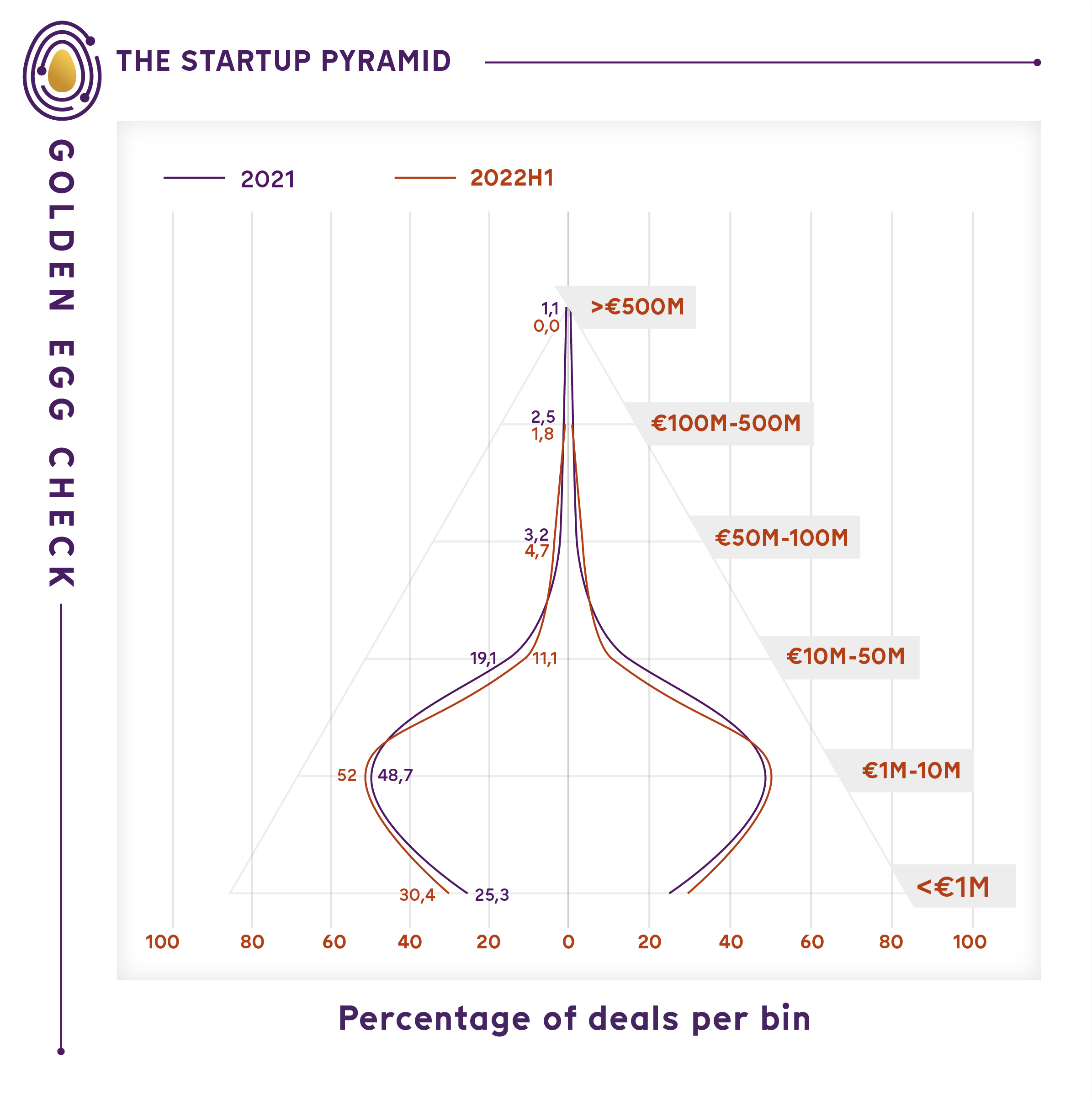

Less large deals

So far we know that amounts in Q1 and Q2 in 2022 are (slightly) below 2021’s amounts. How can that be explained? Let’s have a look at the Startup Pyramid, our way to present the startup ecosystem. At the base are early-stage startups, in the middle are scale-ups and at the top the unicorns. It can serve as an indicator of the maturity of an ecosystem. This is the Startup Pyramid in which we compare the deal sizes in H1 2022 with 2021:

This year we haven’t seen any mega rounds of €500M and up, and ‘only’ three rounds of €100M+ (Leyden Labs (€125M), Backbase (€120M) and Pyramid Analytics ($120M)). The biggest impact though seems to be in the €10-50M category (probably Series B+). Last year 19% of the deals were in that bucket (53 in total) and this year only 11% (19 in total).

Ideally you want the Startup Pyramid to be as wide (more startups raise funding) and high (company raise larger amounts of funding) as possible. To summarize 2022 so far: the pyramid did grow in wideness at the base (on track to have higher number of deals below €10M) but it didn’t grow in height. Perhaps this could still happen later this year when companies need to raise again and investors are willing to invest larger tickets again (at favorable deal terms?).

Winter or just a correction?

Depending on who you ask, some will argue that the good times are over: interest rates and inflation are going up, so risk-appetite goes down and other asset classes become more appealing. On the hand, others (including myself) think it will be just a temporary dip in venture capital investments. I believe the market has created a momentum for technology companies, including more, and more specialized and professional investors, more angels with operational scaling up experience, and a more obvious career path for tech talent.

If you want to know what some Dutch venture capital investors expect and advice to founders, please listen to our podcast episode on the market circumstances (in Dutch):

Interested to get more insights?

Consider to join our freemium data & dealflow plan for VCs and corporates. You will receive:

- Monthly overviews of startups and scale-ups that are currently ‘on the market’ for funding that we can give you access to

- Quarterly reports of all funding data: companies, investors and (estimated) investment amounts and sources

- Yearly in-depth report of funding data & insights

We also have a plan for angel investors that focuses on dealflow only. Sign-up here for free and start your trial.

* Other partners of the Quarterly Startup Report include: Techleap, Dealroom, NVP, Dutch Startup Association, KPMG and the Regional Development Agencies. Read the press release here, and watch the overview of most startups here. Some numbers in this article might slight deviate from the Quarterly Startup Report because of new data & insights.