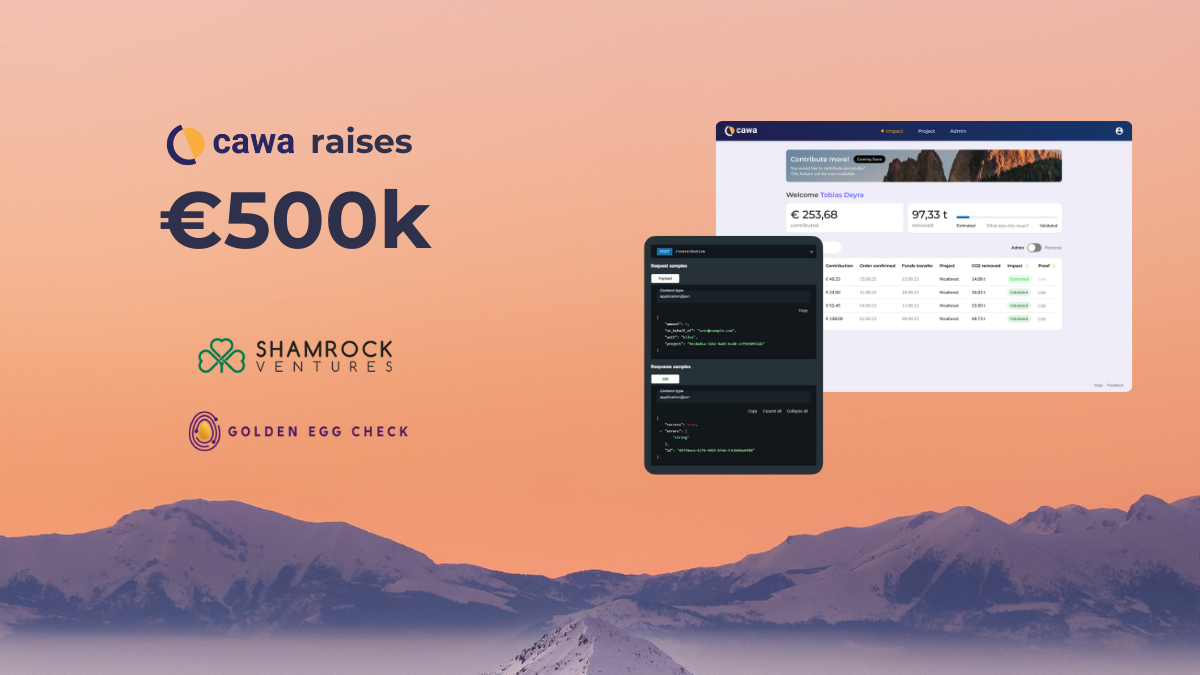

Amsterdam, June 2024 – Cawa, an API infrastructure enabling carbon accounting and ESG platforms to sell transparent, high-quality carbon credits, has raised 500K in a new funding round. The round was led by Shamrock Ventures, a venture capital fund specializing in sustainable technology investments, and supported by Golden Egg Check Capital and experienced angel investors.

Cawa arrives at an important moment for the Voluntary Carbon Market (VCM). To meet the Paris Agreement goals, large-scale investments in climate projects, such as reforestation and innovative carbon removal initiatives, are essential. The VCM enables project developers to secure funding for these projects, as companies can purchase carbon credits from them. It also has a trust problem, as seen in several public exposés on climate projects not delivering on their promises or funding ending up in the wrong pockets. This holds companies back from funding climate action in the VCM.

In order to bring more companies to the VCM, Cawa addresses three key issues. First, currently the market is highly opaque, with up to 85% of climate financing from companies not reaching the climate projects but going to intermediaries. Second, many projects’ carbon credits do not genuinely guarantee the removal or reduction of 1 tonne of CO2. Lastly, companies have a hard time communicating their climate contributions through carbon credit purchases.

Cawa’s API platform allows platforms and companies to integrate the purchase of transparent, high-quality carbon credits. The APIs also enable linking each carbon credit transaction to individual customers, employees, or other stakeholders, providing complete information about the impact of these contributions.

Cawa’s experienced founding team has 10+ years of climate and carbon markets experience and 20+ years of experience building software solutions at scale. Platforms in the Netherlands, the United Kingdom, Denmark, and Spain are already utilizing Cawa APIs.

Kees van Santen, co-founder of Cawa, says: “This funding round demonstrates investors’ belief in the necessity of a transparent voluntary carbon market with high-quality carbon credits. The goal is to support as many good climate projects as possible by helping them secure funding. With this investment, we can assist more companies in responsibly purchasing carbon credits and developing climate projects.”

Tommy Hurley, managing partner at Shamrock Ventures, adds: “Cawa’s unique software and transparency are crucial to build trust in the carbon credit market. We are excited to support Cawa in their mission to help remove megatons of CO2 from the atmosphere.”

Ytsen van der Meer, venture partner at Golden Egg Check Capital, adds: “Cawa presents a compelling opportunity in the rapidly growing carbon credits market, offering a transparent and scalable solution through their API infrastructure. We’re impressed by Kees van Santen’s deep industry knowledge and clear vision, which positions Cawa to significantly impact the sector and drive real environmental benefits.”