What’s happening?!

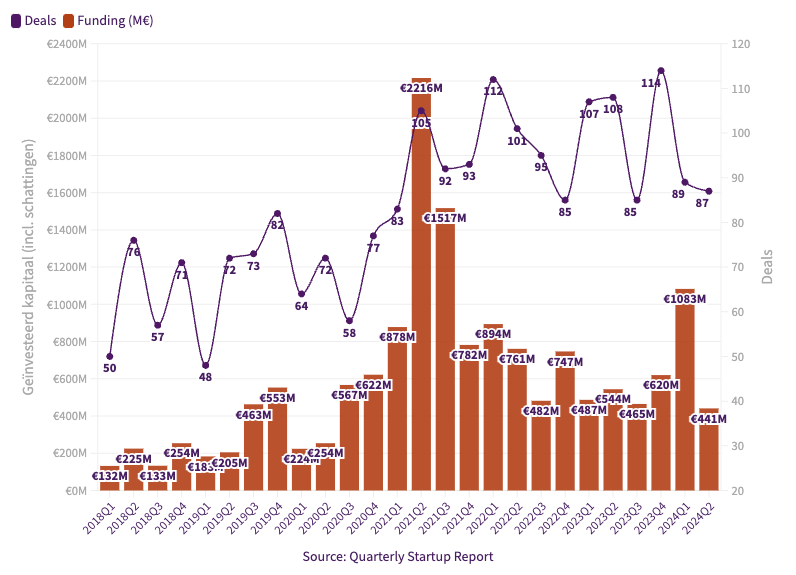

The growth of investments in Dutch startups is not continuing. After a strong first quarter, investments in Dutch startups have declined compared to Q1. ‘Only’ €440M was invested in Q2. The number of deals has decreased by 20% in total compared to the same quarter last year.

This is the main insight from the Quarterly Startup Report, a quarterly data analysis of Dealroom.co, Golden Egg Check, KPMG, the Regionale Ontwikkelingsmaatschappijen (ROM’s), Nederlandse Vereniging van Participatiemaatschappijen (NVP), Techleap, Invest-NL and Dutch Startup Association (dSa).

The decline is also due to the size of the investments: especially very large rounds of around €100M and higher were missing this quarter. These rounds are exceptional and difficult to predict in the Netherlands anyway. Compared to the second quarters in previous years, there is now also a decline:

Thomas Mensink comments on behalf of Golden Egg Check: “It is striking that in 2024 there have been almost half fewer investments in the segment from 4 to 15 million euros. These are typical Series A rounds. Where previously the challenge was mainly in the early phase, up to 1 million euros, and the large rounds in the later phase, it now seems to be in the middle. Perhaps companies are still waiting for the right time to come back to the market for their Series A round.”

A significant part of the decline comes from the number of Series A deals (€4-15M) which went from 20 in Q2 2023 to 10 last quarter. In the early phase, in rounds up to €1M, the number of investments increased, from 14 to 19, compared to the first quarter.

The top 10 largest deals of the past quarter:

- Axelera AI $68M

- BioBTX €42M (though total round including loan and subsidies was €80M)

- Mosa Meat €40M

- bunq €29M

- CuspAI $30M

- Qblox $26M

- Vitestro $22M

- Flindr Therapeutics €20M

- Nebul €20M

- Vico Therapeutics €11.5M (second closing part of Series B financing round, totalling €65.8M)