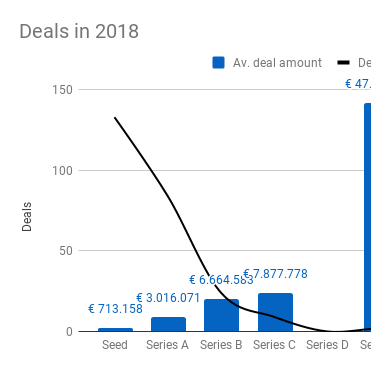

This is what gender diversity in the Dutch startup ecosystem looks like

Last year, some Dutch VCs launched a ‘diversity statement’, called #FundRight. The aim of this movement is to bridge the gender funding gap and achieving a divers startup ecosystem. [...]