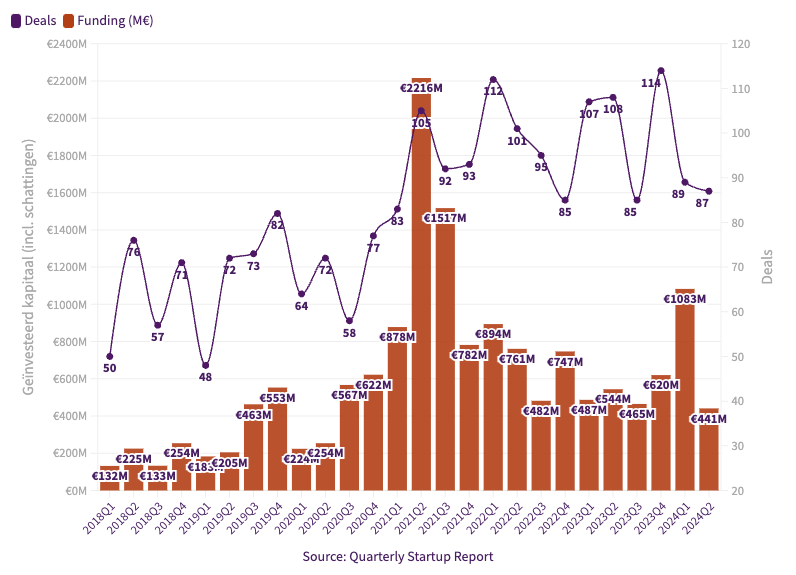

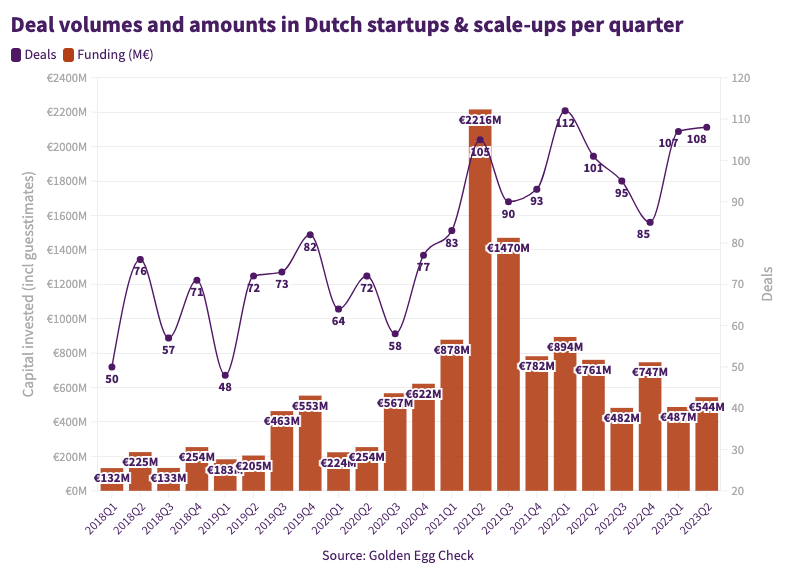

Groei investeringen in Nederlandse startups zet nog niet door

Golden Egg Check heeft samen met Dealroom en de partners van het Quarterly Startup Report consortium becijfert hoeveel er in het eerste kwartaal in Nederlandse startup en scale-ups is geïnvesteerd. [...]