Strong year despite weak fourth quarter

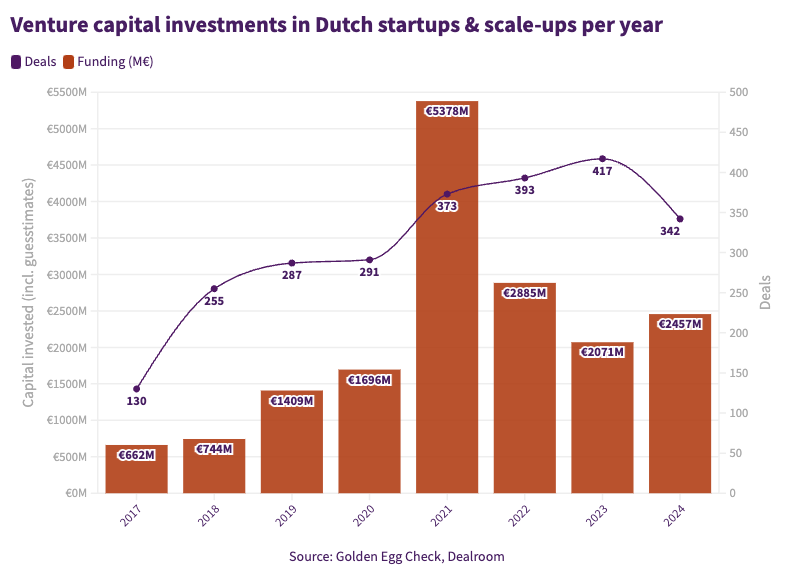

2024 was the third best funding year ever for Dutch startups, following the peak years 2021 and 2022!

Dutch startups and scale-ups raised a total estimated amount of ca. €2.5 billion in 2024, an increase of 19% compared to 2023, when €2.1 billion was invested. In peak year 2021 this was €5.4 billion and in 2022 €2.9 billion.*

These are the main insights from the Quarterly Startup Report, a quarterly data analysis by Golden Egg Check together with Dealroom, KPMG NL Emerging Giants, the Regionale Ontwikkelingsmaatschappijen (ROM’s), NVP, Techleap, Invest-NL and Dutch Startup Association.

The top 3 biggest investments in Q4 of 2024 went to:

- Citryll – €85 million

- Cradle – $73 million

- Meatable – €30 million

At first glance, things might look promising, but don’t be fooled! Despite these strong figures, there was a decline in the fourth quarter:

- In Q4, €460 million was invested, 26% less than in Q4 2023 (€620 million) and 2% less than in Q3 2024 (€470 million)

- The number of deals decreased by 25% compared to Q4 2023, from 114 to 85

We identify some key challenges:

1) 𝙩𝙝𝙚 𝙣𝙪𝙢𝙗𝙚𝙧 𝙤𝙛 𝙙𝙚𝙖𝙡𝙨 𝙖𝙧𝙚 𝙨𝙞𝙜𝙣𝙞𝙛𝙞𝙘𝙖𝙣𝙩𝙡𝙮 𝙙𝙤𝙬𝙣 𝙘𝙤𝙢𝙥𝙖𝙧𝙚𝙙 𝙩𝙤 𝙥𝙧𝙚𝙫𝙞𝙤𝙪𝙨 𝙮𝙚𝙖𝙧𝙨

In 2021, 2022 and 2023 there were ~415 investments per year (or ~105 per quarter). In 2024, we only saw 342 published rounds, so an 18% decrease.

2) 𝙡𝙚𝙨𝙨 𝙖𝙥𝙥𝙚𝙩𝙞𝙩𝙚 𝙛𝙤𝙧 𝙥𝙧𝙚-𝙨𝙚𝙚𝙙

In 2024, both the *number* and the *percentage* of deals below €1M went down. While in 2023 still 1/3 of investments was below €1M, in 2024 (remember, with less deals to begin with) that share decreased to only 25%.

3) 𝙛𝙪𝙣𝙙𝙧𝙖𝙞𝙨𝙞𝙣𝙜 𝙩𝙖𝙠𝙚𝙨 𝙡𝙤𝙣𝙜𝙚𝙧

This is more anecdotal than I can show proof with our funding numbers, but both for startups and investors the fundraising landscape has become more challenging. Startups have a harder time to raise a follow-on rounds (there were less Seed and Series A rounds), so they need extension/bridge/top-up rounds in order to survive. Also VCs need more time to raise their funds, and more often than not settle for a lower fund size than their initial target. Some funds even decide to quit or stop raising a next round (did you see Prime Ventures in FD this morning?).

All in all, 2024 was still a top 3 year for venture capital in the Netherlands. Q1 was a very strong quarter, the rest was… mwah.

Thomas Mensink comments:

“After a good start in the first quarter, I had expected and hoped that after almost two years of relative status quo, investment growth would pick up. Unfortunately, that was not the case. Many startups are having a harder time attracting follow-on funding, investors often have to step in with additional capital and they themselves need more time to raise new funds. So there are still many challenges. A better exit market in 2025 can ensure that investments also come on stronger.”

We’ll dive a bit deeper with our funding analysis in the next weeks, because we think there are some more interesting insights to gain from this! Have a look at all investments in Q4 2024 here.

* Golden Egg Check makes educated guesses for the undisclosed amounts, so we are able to make a good and consistent estimation about the state of venture capital in NL. The known/disclosed amount in Q4 was €416M and in 2024 €2.3B