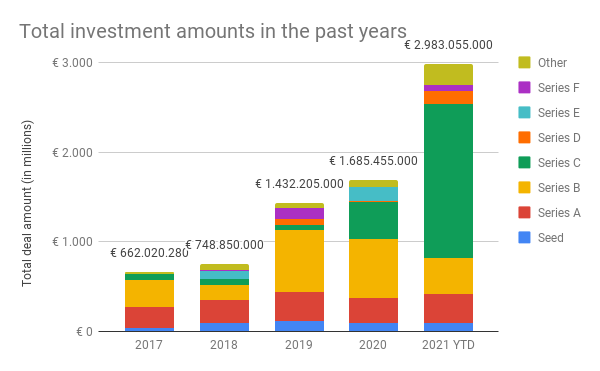

Yesterday, we announced the key conclusions of our funding analysis of 2021 so far. Dutch startups & scale-ups raised almost €3 billion in venture capital in the first half of this year, a new record. Together with our partners* we created the first Quarterly Startup Report to get better insights on the Dutch tech ecosystem.

Let’s dive a bit deeper today. We at Golden Egg Check spend a lot of time categorising startups and deals, so with our dataset — probably the most extensive dataset in the Netherlands—we can try to shed a bit more light on what’s going on with Dutch tech companies.

Number of deals increased

Compared to previous years startups announced more deals in 2021. Especially in March and April, we see that the number of investments has increased. This is probably also related to the corona-pause we saw last year when from March to May some deals got cancelled or postponed. It seems that the speed has picked up again.

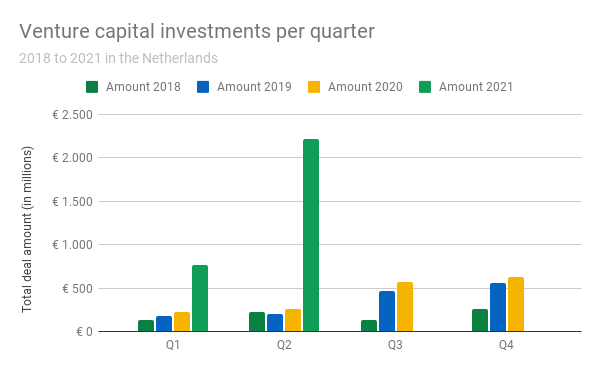

More invested in Q2 than in 2020

Last year, 2020, Dutch companies raised a record amount of €1.7 billion in venture capital. In Q2 of this year, we’re already at almost €2.2 billion. So in just one quarter, companies raised more than in the entire year last year.

Sharp increase in large, later-stage rounds

Two companies contributed a lot to this: Messagebird and Mollie. They both raised an $800 million Series C round last quarter. Other large rounds were:

- bunq (€193M)

- NewAmsterdam Pharma ($196M)

- Otrium (120M)

- LUMICKS ($93M)

- Dott ($85M)

- BUX ($80M)

- Lightyear ($48M + €20M)

More and larger later-stage deals are an indication that the Dutch tech and venture capital ecosystem is maturing. It’s not just a later-stage party though. Early-stage rounds (Seed and Series A) are also on track to increase last year’s amount; the total deal amount is halfway in more than half of 2020’s, and their median values have increased significantly.

In this graph you see a lot of green on the right-hand side. Those are the Series C rounds, 13 in total. The median (so not average) value of these Series C rounds so far is €32 million. This has more than doubled compared to the median value in 2020 (also 13 deals). In other words; Series C rounds have gone up in size, and are halfway through at the same number as the full last year.

Series B rounds are a bit behind this year, given the overall growth. We have seen 25 Series B rounds this year, and 44 in 2020. The median value is € 6.375.000 while last year (with some incredible rounds of a.o. Mollie and some biotech companies) it was at € 9.250.000. Some of the companies that raised a Series B last year did raise a Series C round this year (e.g. Otrium, Stream.io and Wonderflow), so companies are moving up in the funnel.

The birth of a new unicorn

While Mollie and Messagebird again raised incredible amounts, bunq became the latest member of the unicorn club. The online bank raised a €193 million round at a €1.6 billion valuation. Although the details about the deal were announced in July, we included them in Q2 because that was when FD already had the ‘scoop’.

Because it’s a bit of an odd case (founder Ali Niknam funded the company’s growth with millions of his own capital) we labeled the round as ‘Other’ in the graph above.

More data & dealflow?

Interested to invest in Dutch companies and see them before others do? Contact us to discuss our data & dealflow plans. We keep track of many companies as well as investors in the Netherlands — and are often in close contact with them. We can help you to get access to the most relevant dealflow, including the companies that raised funding in 2021 so far and are part of our dataset.

*Partners are: Dealroom.co, Dutch Startup Association (DSA), KPMG, de Regionale Ontwikkelingsmaatschappijen (ROM’s) and Techleap.nl