Startups want to become successful and investors want to invest in successful startups. But how can one estimate which startup is likely to become successful and how can one develop strategies to increase the probability of startup success? In this blog post we introduce our methodology; the Golden Egg Check (or: GEC) Matrix, also known as Startup Matrix.

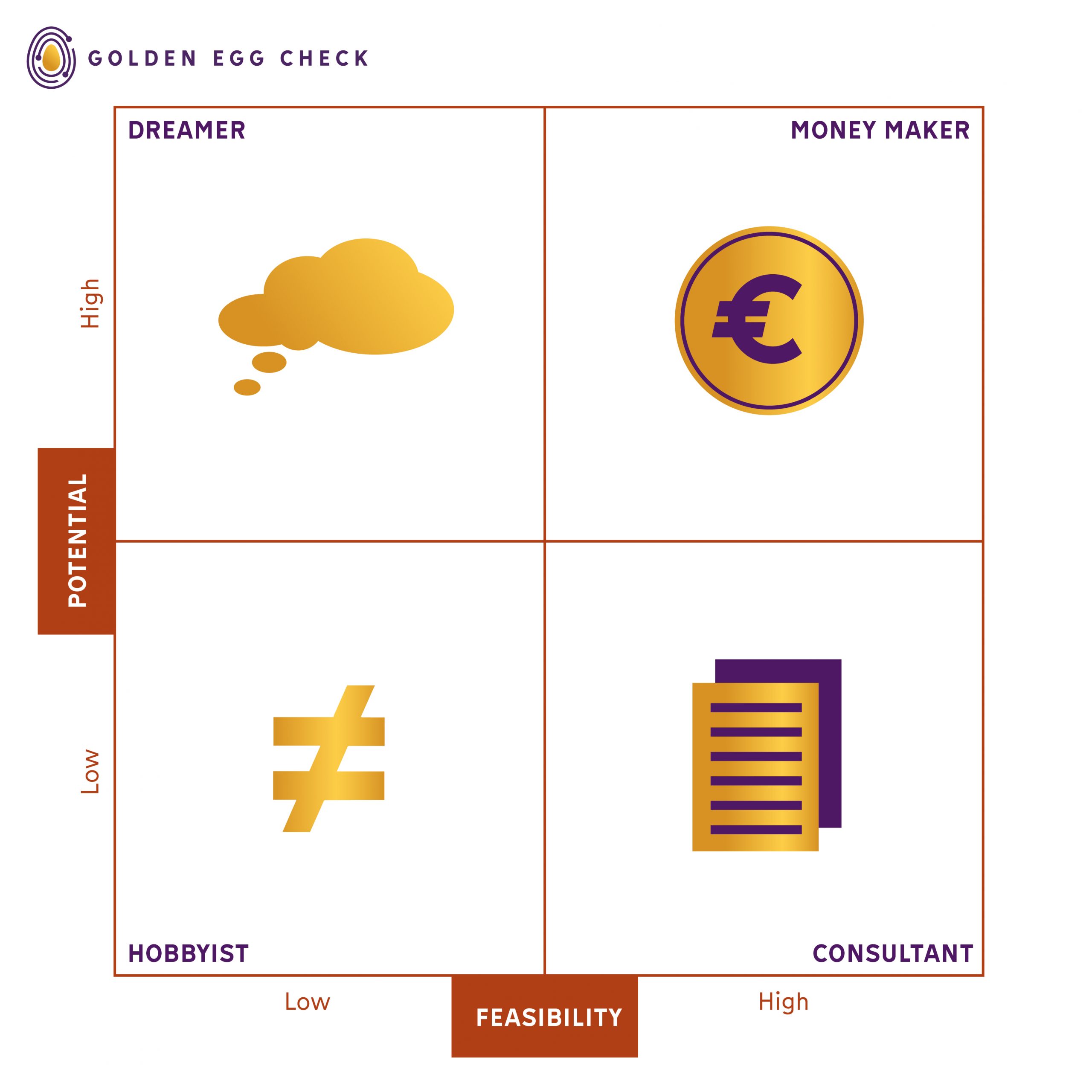

The Startup Matrix is created by Golden Egg Check to visualize the most essential success indicators of an early stage startup or business case: (short term) feasibility and (long term) potential. The rationale behind this is that startups not only need to have the potential to generate cash in the long run, but they also have to be able to actually reach that potential before they run out of money and die in the ‘valley of death’. Short-term survival and long term success should be in balance.

In a way, the Startup Matrix is the startup equivalent of the BCG matrix. This famous model is not applicable to startups as one of the two variables, market share, is close to zero for any startup. Moreover, there can be a situation where a startup is gaining a large market share in a niche market, or a small market share in a mass market. Market share is not the dominant metric for a startup.

Nevertheless, the Startup Matrix has a similar usability and four quadrants, which we will introduce below.

Hobbyist: This is a startup with limited feasibility and potential. The commercial success of this type of startup is expected to be low, and this startup should be repelled or adjusted significantly. In lean startup terminology: it’s time for a pivot.

Consultant: This type of startup generates enough cash in the short term, but lacks an interesting commercial perspective in the long run. This could be interesting for the time being but is not a startup to invest in for a typical venture capitalist, unless the long-term benefits can be increased. Please bear in mind that this can be a low-risk type of startup where you can make sufficient money and enjoy your career, which can be great for a lot of (aspiring) entrepreneurs.

Dreamer: This is a common type of (innovative) startup: success is projected in the long term but the startup has a low feasibility in the short term. This could be problematic, as the potential of the startup cannot be (fully) reached due to liquidity problems. Many high-tech startups are in this quadrant, where they have long time-to-market and will need deep pocket to get their first customers.

Money Maker: This startup has both long term potential and a solid strategy to reach it. As a startup, you ideally are in the Money Maker quadrant. Also, this is the most interesting type of startup for investors, because the risk-return ratio is better aligned.

To use the Startup Matrix, analysts plot a scatter graph to rank and analyze a (portfolio of) startup(s) on the basis of their feasibility and potential. We use Golden Egg Check’s criteria to assess both aspects. Golden Egg Check’s ‘investor readiness check’ contains 21 criteria that (venture capital) investors find most important in their assessments. Each of these criteria is categorized into ‘potential’, ‘feasibility’ or both. For example, if a startup can demonstrate a market demand, then it has some proof that its value proposition fits with the market, increasing its feasibility. Moreover, if a startup has a scalable business model in a large and/ or growing market, then it is designed to scale and grow fast, adding up to its potential.

Strategies to become a Money Maker

A successful startup has potential and a strategy to reach that potential. Successful startups can therefore be found in the Money Maker quadrant. Startups not (yet) in the Money Maker quadrant can develop strategies to eventually reach this quadrant. Below we’ll share some of the most important findings so far. More (extensive) strategies will be added to this blog later.

- Startups in the Dreamer or Consultant quadrant can improve their business case and enter the Money Maker quadrant; startups in the Hobbyist quadrant should first move their business case forward to become a Dreamer or Consultant.

- Dreamers should increase their feasibility or buy extra time. Generally, Dreamers should generate more cash flow, for example by selling services to fund the product development. Another option could be to raise external (venture capital) funding, to increase their runway.

- Consultants should increase their potential. One major step forward could be to increase their scalability, for example by productizing their knowledge, in order to shift from services or customized products to scalable products. This creates a lower dependency on the time constraints of the entrepreneur(s) and will make the business model more scalable.

It is unlikely that a startup can increase its potential score while maintaining its feasibility score and vice versa. Startups can develop strategies to increase their feasibility at the cost of their potential (and the other way around), for example by selling services next to their (scalable) product development and sales. This strategy will increase their cash flow in the short term and thus their feasibility, but shifts focus from the scalable side, (temporarily) decreasing their potential score. For this reason one will see curved arrows in the figure below, indicating a trade-off between feasibility and potential in their strategies to become a Money Maker.

How to use the Startup Matrix in a startup or portfolio

Analysts, investors, mentors and startups can apply the Startup Matrix in various ways. First of all, one can make a rough estimate in which quadrant a startup or business case is, and develop strategies accordingly. Second, one can categorize its own checklist with criteria into potential or feasibility (or both) and make a more structured and objective method to determine the nature of the startup or business case. Third, one can use the Golden Egg Check software to use our dedicated ‘Investor readiness check’ to assess the potential, feasibility and investor readiness of startups and business cases. We can help you to structure you innovation funnel or dealflow model, customized to your needs.

The Startup Matrix is now a standard feature in our software. Contact us for more information and/ or a demonstration.