Investing in startups is obviously risky. With Golden Egg Check Capital we aim to mitigate these risks in a number of ways with our investment strategy. In this way we believe we can achieve a strong returns for our investors.

GEC Capital I is a co-investment venture capital fund, we invest tickets up to €100k together with specialized lead VCs (or highly relevant angels). Here are three reasons why we think this strategy works:

- Co-investing with conviction-based specialists

- Diversification: investing in 30-35 companies

- Follow-on investments in our winners

Let’s discuss a bit further.

Co-investing with conviction-based specialists

We invest alongside VCs or angels that have deep domain knowledge and often are conviction-based, which means that they cherry-pick a relatively small number of companies to invest in and support them very hands-on. We thankfully leverage their expertise, network and – quite frankly – hard work, and join rounds on the terms they’ve negotiated with founders. Our complementary added-value lies in the access to capital as well as in a community of founders that is willing to support each other.

Diversification: investing in 30-35 companies

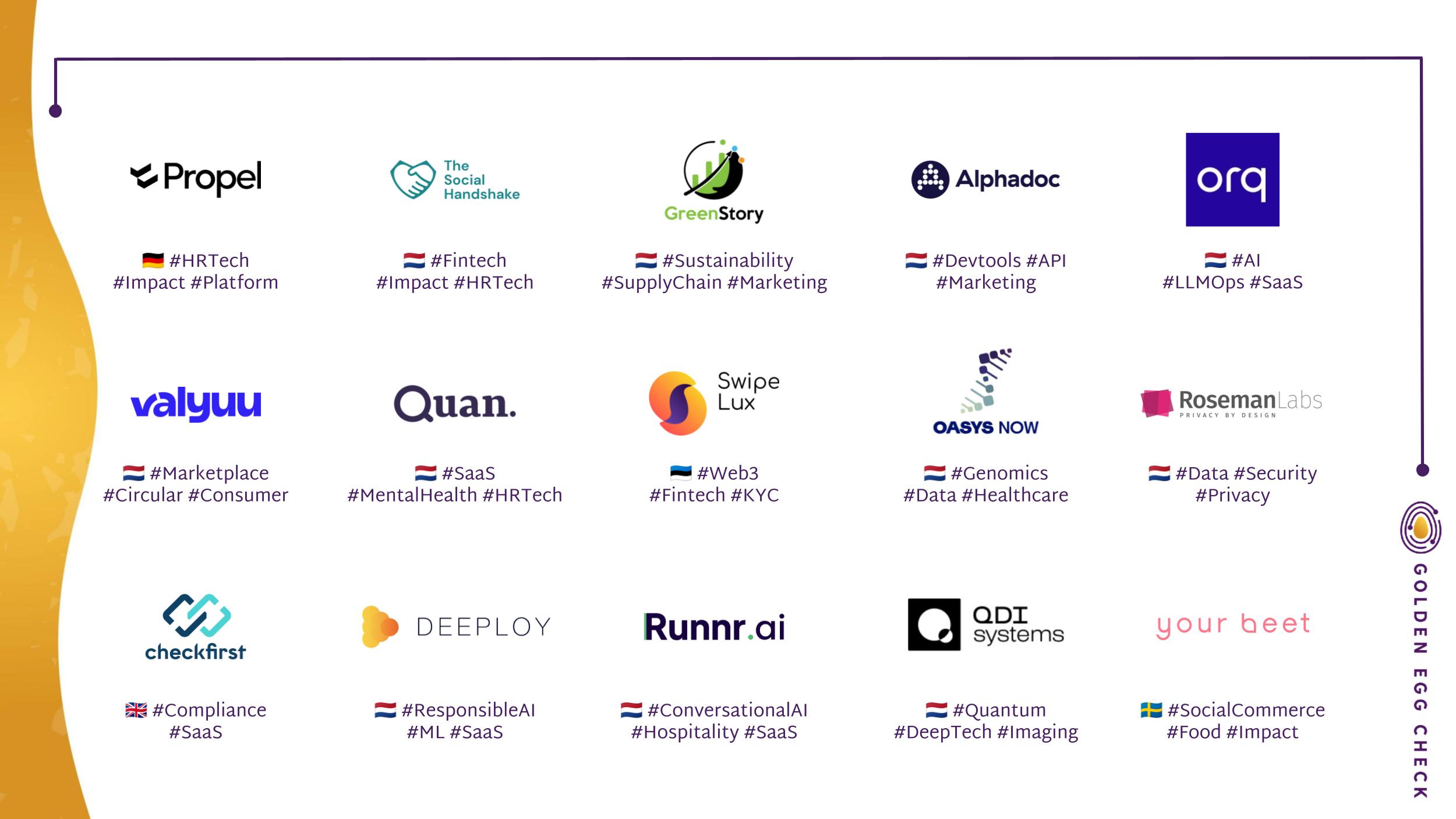

We invest primarily in pre-seed and seed stage companies when we expect a strong value increase. Yes, this early stage is riskier, because often product-market fit has not been found yet. We therefore focus a lot on the size of the opportunity in the market, the scalability of the tech and, of course, the quality of the founders. Running a startup is very hard, and setbacks *will* happen, so we’re looking for founders that have a get shit done mentality and know how to hustle hard! We will invest in 30-35 companies in just three years time, to be sure we spread risks well. Currently we’re half way in with sixteen amazing portfolio companies. Our startups are also diversified in terms of business model, market domain and geography.

Follow-on investments in our winners

We keep a little over 50% of our fund as reserve for follow-on investments in next rounds. This way, we can build relationships with our founders, see which companies outperform our expectations and invest in the winners.

I must admit, our investment strategy does come with some drawbacks, primarily due to the relatively small stakes we own in our portfolio companies. However, we place less emphasis on ownership and more on the benefits of having a large portfolio and building a strong community and great relationships with the founders we have backed. We believe this approach makes our investment strategy quite clever 🙂

Here’s the good news. We’re working towards the final close of our fund, capped at €5 million, before summer. We’re still looking for some investors to join our fund. The minimum ticket is €100k. In other words, and to summarize this long post, if you want to invest €100k or more across 30-35 startups (of which sixteen are known already!) in rounds together with top tier VCs, and be part of our community of founders and (ex-) entrepreneurs, do contact me to discuss!