Last week Thomas Mensink had the opportunity to speak at the TNO Tech Transfer event in Delft. In their Tech Transfer programme, TNO turns in-house technologies into (deeptech) startup companies.

My keynote was about the challenges and opportunities for deeptech startups and spinoffs in the Netherlands. We will put a short summary of his talk below.

Challenges of deeptech startups and spinoffs

According to TechLeap’s State of Dutch Tech 2023 report:

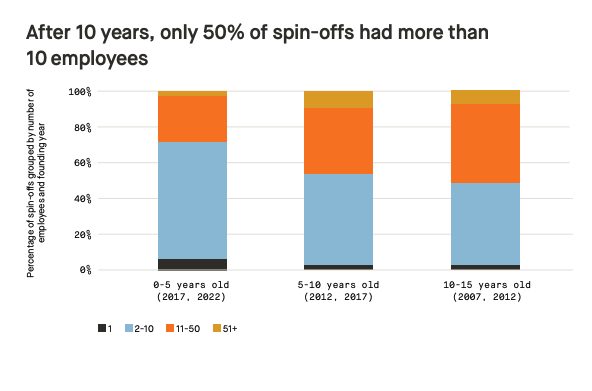

Spinoffs don’t really grow (but forget to die)

80% of all Dutch spin-offs ever created are still active, but after 10 years, only half had more than 10 employees.

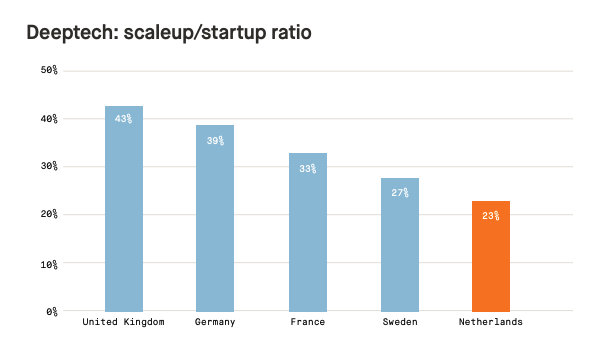

And they don’t scale as often as in other countries

Dutch deeptech is under-invested. They raised only 1/3 of the capital deeptech companies in Germany, France and Sweden raised, and even less compared to the UK. Also, they don’t scale as well as in other European countries.

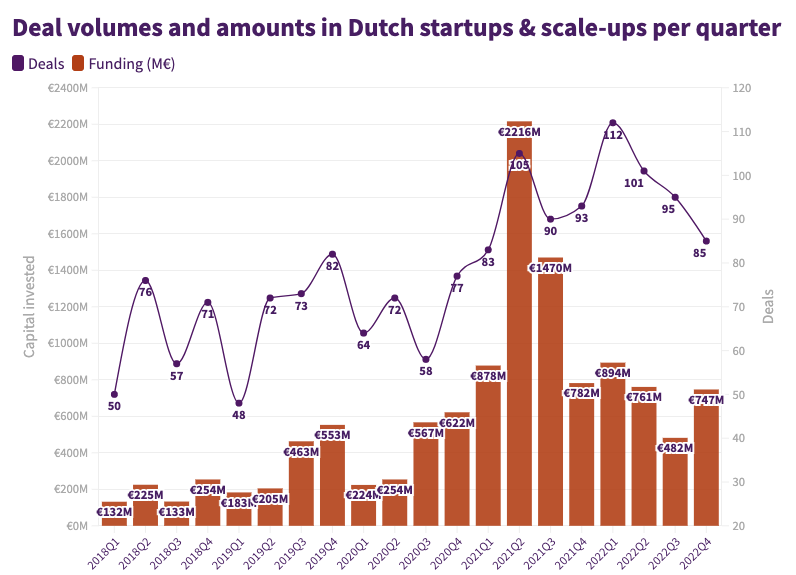

At the same time, the funding market is down

After the exceptional year 2021, investments (in the whole Dutch market, not per se in deeptech) came down in both amount and number of deals:

But there is hope…

We identified three reasons why we are still optimistic about deeptech startups and spinoffs:

- More venture capital available for deeptech

- Steady inflow of (deeptech) spinoffs and patents, and a stronger startup ecosystem

- Better conditions and more mature ecosystem for Dutch deeptech companies, e.g. standardized dealterms for academic spinoffs

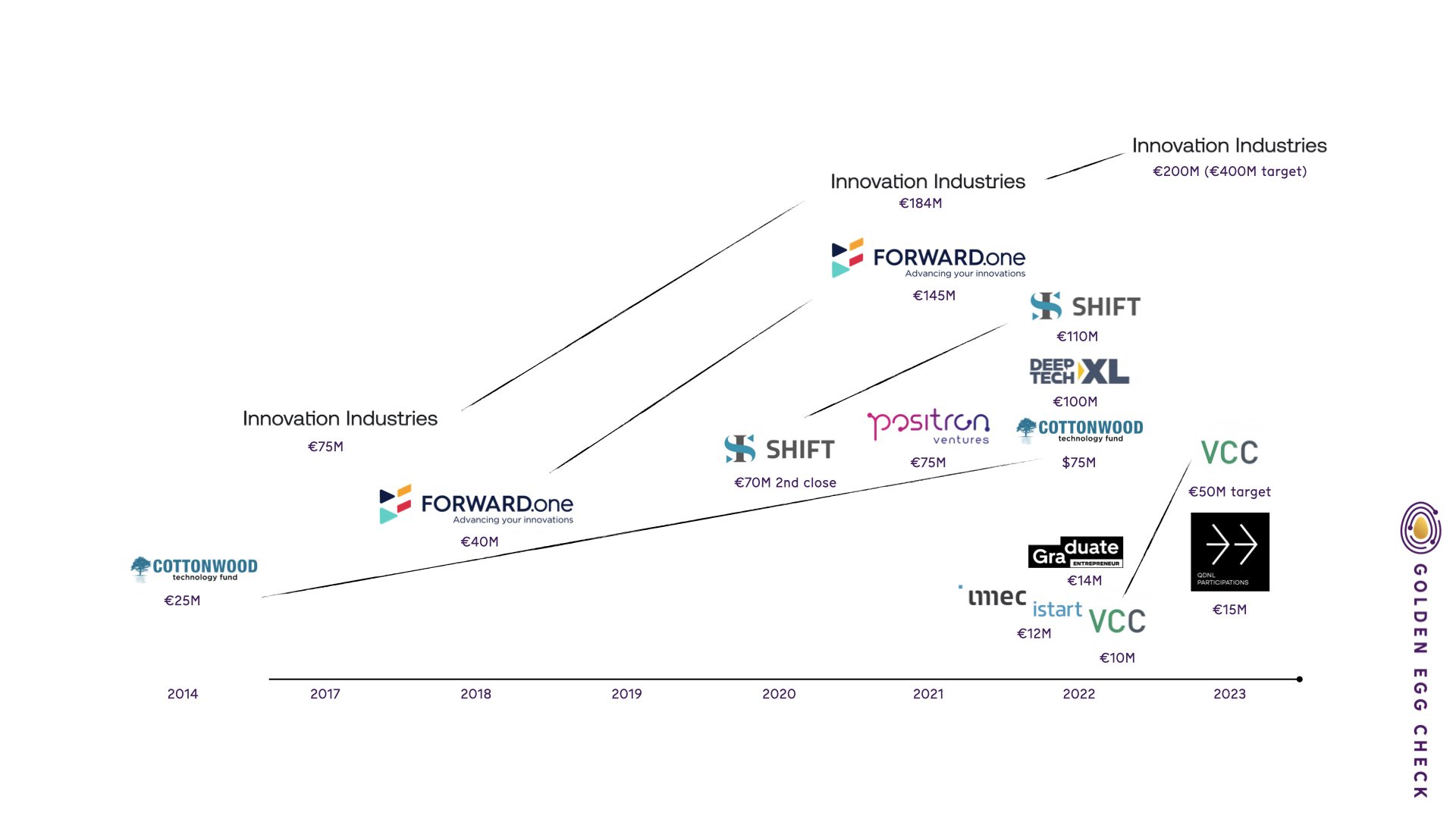

More venture capital available for deeptech

The investment landscape for deeptech has improved quite a bit. We created this overview of funds that we know that are dedicated to invest in deeptech companies. Some funds might be missing (let us know!) and of course there are also other funds that don’t focus on deeptech but do include it in their investment scope.

My take-aways from this deeptech investor landscape are:

- New funds for deeptech companies: more to choose from

- Also bigger funds: bigger tickets, more follow-up rounds, more experience

- Dutch deeptech VCs expand to rest of Europe, so able to compete in a larger market, e.g.:

- FORWARD.one: expands to Nordics & Germany

- Cottonwood: Southwest USA and Northwest Europe

- Innovation Industries: “a European deep tech venture capital fund”

- As far as I see: most deeptech companies are funded by Dutch investors (regional funds, VCs, Invest-NL)

So all in all, we are quite optimistic about the future of deeptech startups and spinoffs in the Netherlands. The challenges remain, but there definitely seems to be momentum for Dutch deeptech.

Contact us if you want to know more about deeptech companies that fit your fund or company, or if you need an introduction to any of the investors mentioned in the landscape (as startup or fund investor).